The 2017 energy year for New Jersey closed at the end of May, and with the latest NJ Office of Clean Energy Solar Activity Reports we have our first indication of total development activity for the full 12 months of the previous compliance period. We have taken the opportunity to update our state capacity model and dig into the available information in greater detail.

You can find our most recent capacity presentation here.

As of the most recent NJ Office of Clean Energy activity report, which tracks registered assets as of 5/31/2017, New Jersey has built a total of 2,169MW of solar capacity. 345MW of that has been built in EY 2017 alone. The most recently published report showed an increase of 38.9MW in solar installations since the figure reported through 4/30/17. While much of the new capacity was certified in April and May of 2017, an unusually high amount of new capacity was attributed to December of 2016.

- 12MW from May 2017

- 11MW from the period between January and April 2017

- 14MW from December 2016

Given the observed pattern in the delay of these reports accurately displaying the full capacity to be attributed to a given month, we assume that we will see another 5-15MW of capacity added to May 2017 in next month’s activity report, bringing the EY 2017 total new build figure in the range of 350MW to 360MW.

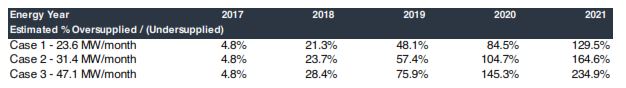

In terms of EY 2017 SREC supply and demand, our analysis shows that 2017 will be slightly (4.8%) oversupplied, but with the implied growth rate of 30MW/month quickly outpacing the growth of the RPS solar carve out schedule. Given a base case of 30MW/month and an assumption of flat load growth, we see an 24% oversupply in 2018 and a 57% oversupply in 2019.

An important piece of information to note however is that state electricity sales have shown a consistent negative trend, with sales dropping from over 83mm MWh in 2007 to 74mm MWh in 2016. This is an annualized rate of decrease of slightly more than 1% over the previous 10 years. We have included scenario analysis for both a flat load growth scenario as well as a negative growth scenario. Below demonstrates flat load growth scenarios.

Given the high likelihood of significant market oversupply in coming years, either a drastic slow down in build rates or an expansion of the New Jersey SREC program requirements would be needed to address forecasted supply and demand dynamics. Industry stakeholder groups are currently in process of evaluating how expanded NJ RPS requirements may be feasible in the framework of the existing program.

As always, we will follow the legislative process closely and keep our clients updated on any substantive changes in the market. Please feel free to reach out to your brokerage team coverage with any questions or comments.

Disclaimer. This document, data, and/or any of its components (collectively, the “Materials”) are for informational purposes only. The Materials are not intended as investment, tax, legal, or financial advice, or as an offer or solicitation for the purpose or sale of any financial instrument. SRECTrade, Inc. does not warranty or guarantee the market data or other information included herein, as to its completeness, accuracy, or fitness for a particular purpose, express or implied, and such market data and information are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Any comments or statements made herein do not necessarily reflect those of SRECTrade, Inc. SRECTrade, Inc. may have issued, and may in the future issue, other communications, data, or reports that are inconsistent with, and reach different conclusions from, the information presented herein.

Copyright. This document is protected by copyright laws and contains material proprietary to SRECTrade, Inc. This document, data, and/or any of its components (collectively, the “Materials”) may not be reproduced, republished, distributed, transmitted, displayed, broadcasted or otherwise disseminated or exploited in any manner without the express prior written permission of SRECTrade, Inc. The receipt or possession of the Materials does not convey any rights to reproduce, disclose, or distribute its contents, or to manufacture, use, or sell anything that it may describe, in whole or in part. If consent to use the Materials is granted, reference and sourcing must be attributed to the Materials and to SRECTrade, Inc. If you have questions about the use or reproduction of the Materials, please contact SRECTrade, Inc.

Tweet