Quarterly data from the California Air Resources Board (CARB) showed the largest ever credit surplus as prices fell to multi-year lows last month. Earlier this week, CARB postponed a March hearing to consider reforms to the LCFS program and may be evaluating stricter carbon intensity targets amidst stakeholder pressure.

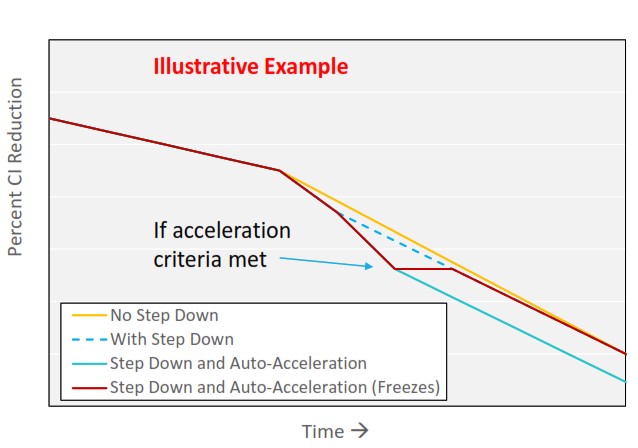

In Q3 2023, 2.2 million more credits were generated than deficits, pushing the cumulative credit bank to over 20M credits and 3.6x greater than the average quarterly deficits generated in the prior year. This last metric is significant under the proposed amendments where an auto-acceleration mechanism (AAM) would be triggered under certain market conditions beginning in 2027.

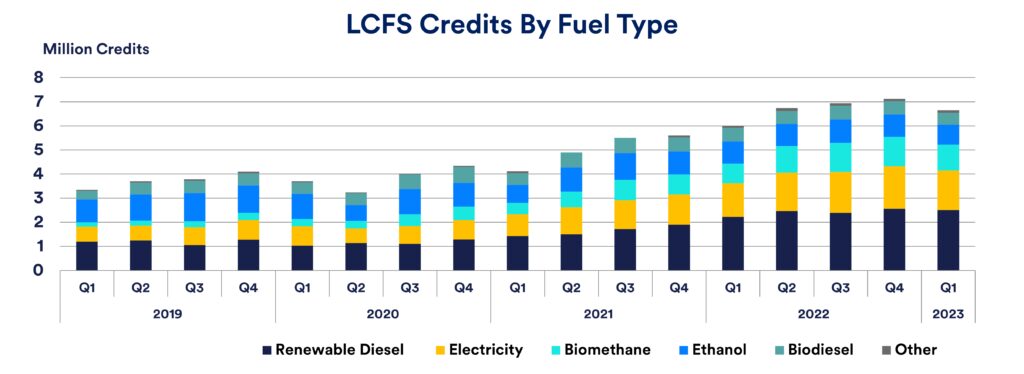

Overall credit generation was up 9% from the previous quarter, driven by increases from the largest credit sources: renewable diesel (12% QoQ), electricity (10%), ethanol (20%), and renewable natural gas (4%). Nearly half of all credits came from bio-derived diesel which now makes up 60% of all diesel fuel consumed in the state.

Growth in credits from EV charging were driven by increases in residential credits awarded to utilities (11%), non-residential charging (17%), and heavy-duty fleet charging (19%). Credits from DC fast-chargers enrolled in the ZEV infrastructure crediting scheme fell by 4%. EVs continue to represent about one-quarter of all credits in the program.

Oregon Clean Fuels Program Data and Rulemaking Workshop

Data for the Oregon Clean Fuels Program indicated a second straight quarter of net credit gains. In Q3, 686k credits were generated compared to just 624k deficits, a net gain of 62k credits. Last quarter saw a net gain of 81k credits, the largest quarterly increase since 2019. Following the trend in California, renewable diesel has quickly become the largest source of credits in the program, growing by 32% last quarter and 187% year-over-year. Credits from electric forklifts were unchanged the previous two quarters after falling over 75% in Q1.

On January 30, the Oregon Department of Environmental Quality (DEQ) held a rulemaking workshop to outline potential changes to the CFP including expanding third-party verification requirements to electricity reporting. The rulemaking will not consider changes to carbon intensity targets which were last updated in 2022. Future workshops are expected March through June.

Tweet