Many SREC markets have been subjected to unprecedented impacts this year from the worst international pandemic in recent history, COVID-19, and Maryland is no exception. Despite some companies having to re-imagine their solar sales and installation processes, the Maryland Clean Energy Jobs Act (CEJA) continues to have a profound impact on the state’s SREC market. CEJA increased Maryland’s Renewable Portfolio Standard (RPS) to 50% by 2030 with a solar carve-out of 14.5% by 2028, more than doubling the 2020 solar requirement in the process. On the other hand, CEJA established a declining solar alternative compliance payment (SACP) schedule set at $100.00 this year but decreasing by $20.00 in 2021 and 2022 and by lower magnitudes thereafter.

In part due to the challenges posed by COVID-19, the MD market saw a decrease in solar build rates. The past 12-month average build rate from Nov. 2019 – Oct. 2020 was 7.79 MW/mo, 23.4% less than the average of 9.61 MW/mo from the 12 months prior.

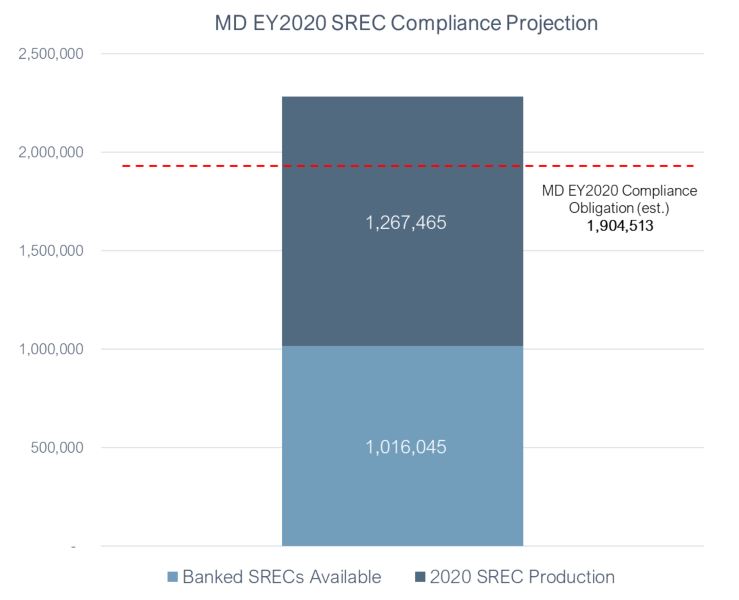

The estimated 2020 electric load is also down from 2019 totals due to decreases in the commercial and industrial sectors, while residential electricity usage saw a slight increase. Our enclosed analysis projects the 2020 market to be oversupplied while forward years will see an increasingly undersupplied market – an indication that build rates must show a significant increase in order to keep up with the current RPS. The final 2020 MD SREC production, final 2020 MD load figures, and actual grandfathered load could impact the degree of oversupply in 2020 and undersupply in forward years.

TweetTags: Maryland