On November 14, the DOER updated the exempt load projections for both SREC-I and SREC-II, as well as provided information on the total volume of re-minted SRECs available in the market. These two data points impact the level of demand and expected supply, respectively.

Briefly on SREC-II, the exempt load numbers for 2016 and 2017 increased slightly, which will in turn lower aggregate demand. We already anticipated those markets being oversupplied and with this new data, this assumption strengthens. See our most recent analysis for a deeper dive.

As a follow-up to our recent post on the MA16 SREC-I market, we will incorporate recent data published by the Department of Energy Resources (DOER) and re-examine supply assumptions to provide another view into the recent weakness in the market.

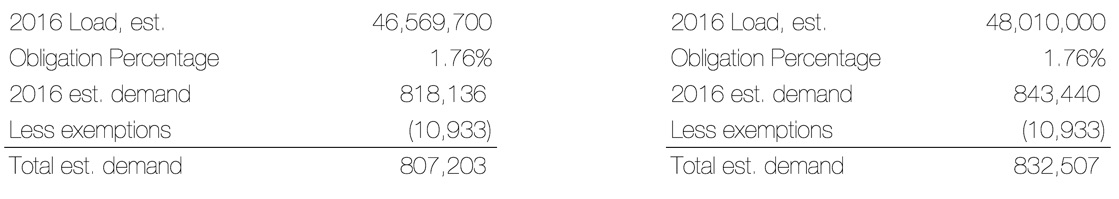

Starting with the demand side of the market, we now project the total market demand for MA16 SREC-I in the range of 807,203 – 832,507, depending on the total amount of electricity sales. Note, the scenario on the left assumes load is down approximately 3% from 2015, while the scenario on the right keeps load flat at the estimated 2015 levels.

For a more nuanced view on the projected supply for the year, we consider using Q3 and Q4 issued SRECs from 2015 as a proxy for this year. Adding those figures to SRECs already issued in Q1 and Q2 of this year results in an estimated supply of 818,761 for MA16 SREC-I.

With the latest data from DOER, we can now add 50,499 additional SRECs to the supply side. These SRECs are re-minted volumes from past Clearinghouse Auctions that are eligible for compliance on 2016. In sum, we anticipate a total supply of 869,260.

When compared to the range of demand we anticipate the market is long by 4%-8% of demand, or 36,753-62,057 SRECs:

Factors that could swing the market one way or the other include how much electricity is sold and how much output comes from the installed capacity. Additionally, although the market is potentially oversupplied, it is possible some participants may not bring supply to the market if market prices are lower than their expectations. This could influence price upward to levels we experienced earlier in the year. On the other side, if natural buy-side demand chooses to take a wait and see approach the efficiency of the market can be impacted and influence price downward. The latter has been the case over the past months as the market has moved down on a dearth of natural buy-side demand.

Tweet