With the October issuance of Q2 2016 SRECs behind us, we are now approximately halfway through the 2016 energy year in Massachusetts. This blog post will take into account observed issuance numbers from the first half of the year and use projections for future issuance periods to understand what caused the fall in MA16 SREC-I prices from $450+ in January to more recent bids of $380. We will look at the supply and demand balance in order to survey what may be coming in the months ahead.

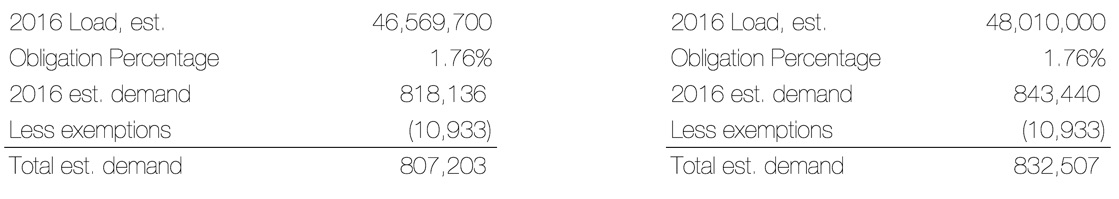

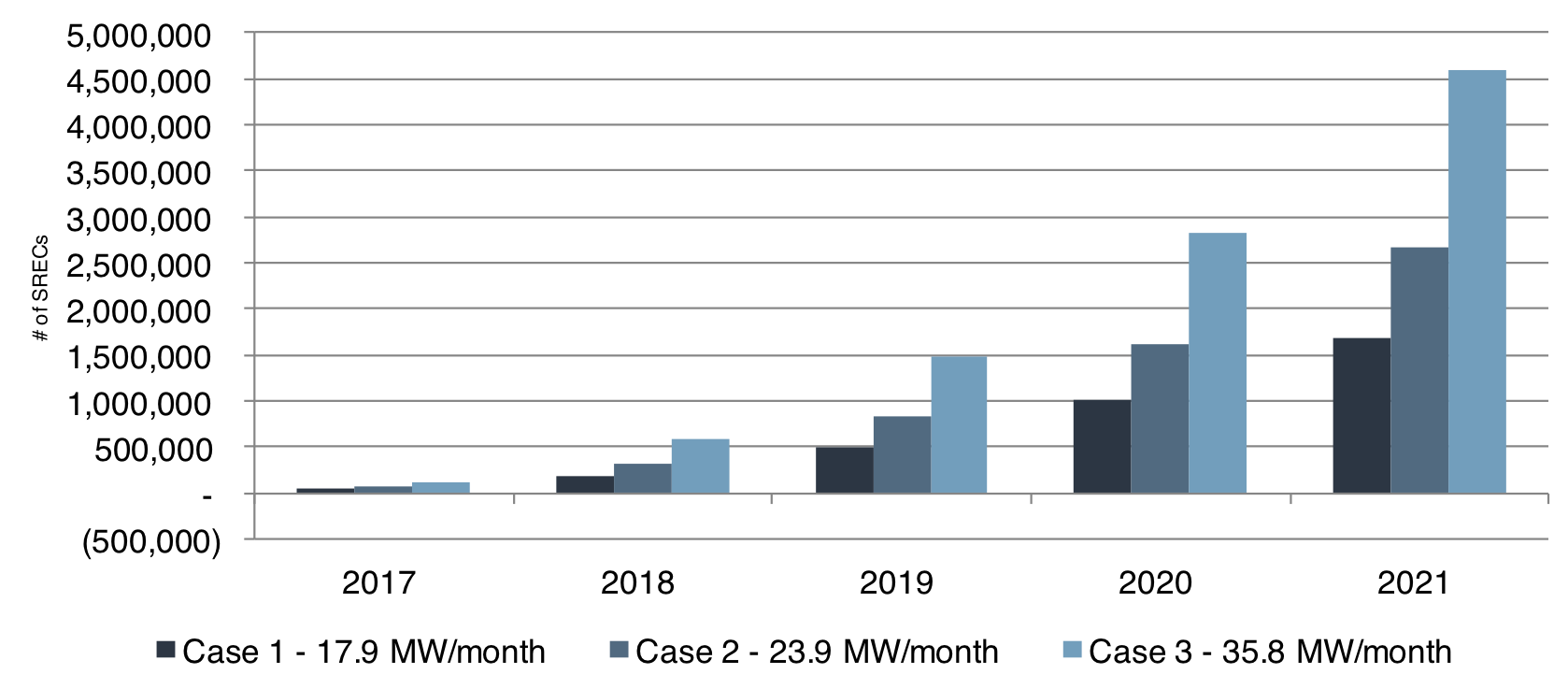

Recall that demand is driven by retail electric sales in the State. The latest data we have comes from 2014, a year in which 48,129,294 MWh were sold. If we assume that retail electricity sales are flat and we apply the obligation of 1.76% and then adjust for exempted load, we derive a total estimated demand of 833,780 SRECs:

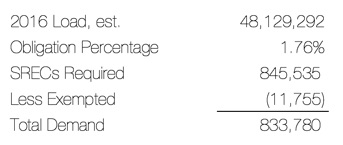

On the supply side of the market, the simplest analysis assumes the market generates nearly 784,000 SRECs and when combined with the re-minted volumes from this year’s SCCA (1,898), then we get a total supply of 785,886. When compared to the demand outlined above, we conclude the market is short nearly 48,000 SRECs.

What would explain falling prices in a market that is potentially under-supplied? The quick answer is that perhaps retail sales of electricity are falling instead of flat, which would lower the demand. Alternatively, perhaps the supply of SRECs is higher than detailed. We’ll examine some supply scenarios first.

One component of supply is the banked SRECs from prior years. Retail suppliers can bank up to 10% of their annual obligation for use in future years. The maximum volume of banked RECs in the market is estimated at 65,382 – the sum of the total obligation in 2014 and 2015 multiplied by 10%. If all of those SRECs were brought to market in 2016, then we would see the market long by 17,488 SRECs. We see that scenario as unlikely since 2015 was short and the bank may have been used to avoid paying Alternative Compliance Payments (ACPs). On the other hand, it’s possible that between re-minted SRECs from the 2013 and 2014 SCCCA and banked volumes, that upwards of 15,000 SRECs from prior vintages may impact the 2016 market. This source of supply would help to tighten the balance of supply and demand, but not necessarily push to over-supply.

Examining a different scenario on the demand side, even if retail sales were down 3%, the total SREC demand would still sit at 808,414, leaving a tight, yet still under-supplied market based on the simpler supply analysis.

Another element worth mentioning is liquidity. While a healthy market needs liquidity from both buyers and sellers in order to function properly, we will direct our attention to the buy-side. Because there are far more sellers than buyers in this market, an absence of even a handful of buyers is far more impactful to the efficiency of the SREC markets than the absence of an equivalent number of sellers.

In recent months we have observed a noticeably subdued level of activity from buyers. What happens when SRECs are issued and a bunch of sellers come into a quiet market? As evidenced from pricing over the last month, bids start to retreat:

A simplistic read of the current state of the market is that prices have dropped due to the possibility of oversupply. However, deeper examination of current supply and demand in SREC-I markets points towards a tighter, more balanced market. The bearish sentiment reflected in recent weeks may actually reflect a lack of activity from natural compliance buyers in the face of a glut of supply coming to market after Q2 issuance. These two scenarios mean very different things for medium to long term “equilibrium” pricing in the SREC-I market. A structural and persistent oversupply, a scenario we do not perceive as likely, would mean that lower prices are justified and here to stay. A mismatch of liquidity due to trading preferences of buyers and sellers however would point towards short term volatility but longer term stability in supportive SREC prices.

As always, we will continue to provide follow-up analysis as more information becomes available. Feel free to reach out to your contacts on SRECTrade’s brokerage desk with any questions you may have.

Disclaimer. This document, data, and/or any of its components (collectively, the “Materials”) are for informational purposes only. The Materials are not intended as investment, tax, legal, or financial advice, or as an offer or solicitation for the purpose or sale of any financial instrument. SRECTrade, Inc. does not warranty or guarantee the market data or other information included herein, as to its completeness, accuracy, or fitness for a particular purpose, express or implied, and such market data and information are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Any comments or statements made herein do not necessarily reflect those of SRECTrade, Inc. SRECTrade, Inc. may have issued, and may in the future issue, other communications, data, or reports that are inconsistent with, and reach different conclusions from, the information presented herein.

Copyright. This document is protected by copyright laws and contains material proprietary to SRECTrade, Inc. This document, data, and/or any of its components (collectively, the “Materials”) may not be reproduced, republished, distributed, transmitted, displayed, broadcasted or otherwise disseminated or exploited in any manner without the express prior written permission of SRECTrade, Inc. The receipt or possession of the Materials does not convey any rights to reproduce, disclose, or distribute its contents, or to manufacture, use, or sell anything that it may describe, in whole or in part. If consent to use the Materials is granted, reference and sourcing must be attributed to the Materials and to SRECTrade, Inc. If you have questions about the use or reproduction of the Materials, please contact SRECTrade, Inc.