The Massachusetts SREC-II program officially launched on Friday, April 25th. The official filing can be found here and program guidelines are here. However, the application window for the new program does not open until May 6th. Any applications submitted to SRECTrade prior to May 6th will be processed with the Massachusetts Department of Energy Resources (DOER) starting on May 6th.

Once a facility receives a Permission to Operate (PTO) from its interconnecting utility, SREC-II applications should be submitted using SRECTrade’s online application. Applicants may also apply for an Assurance of Qualification from the DOER provided that the application meets certain criteria outlined in the “How to apply in the Assurance of Qualification with SRECTrade” section below. The DOER’s official guidelines for Assurance of Qualification are here.

Key highlights of the MA SREC-II program

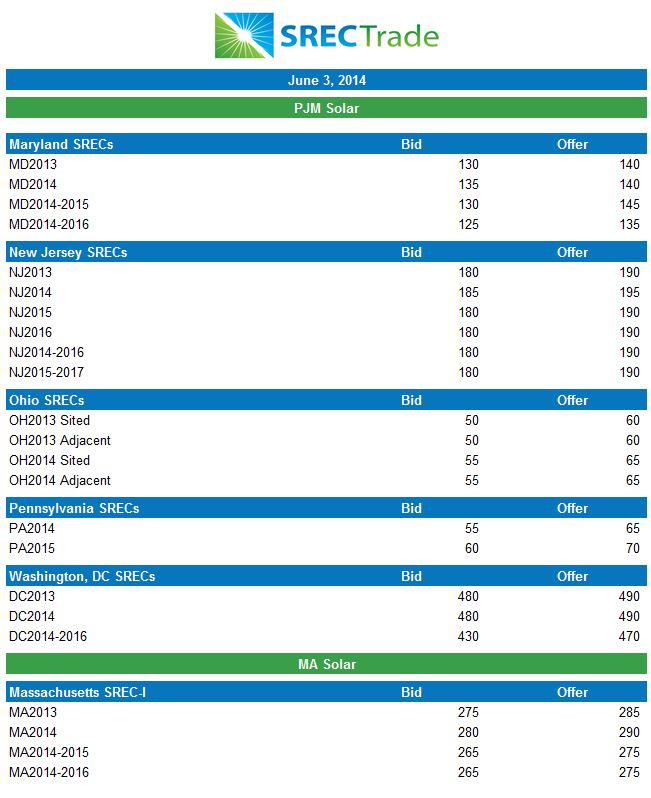

- MA SREC-II system owners can actively market offers to sell SRECs. Contact us directly to help facilitate any orders.

- The total capacity of the SREC-II program will be determined after the final SREC-I capacity is announced; by July 31, 2014 (i.e., 1,600 MW less Total SREC-I qualified capacity)

- Facilities are separated by Market Sectors based upon facility type, size and other characteristics. See below.

- Market Sector eligibility determines the ratio of SRECs issued relative to power produced. See below.

- Facilities greater than 650 kW DC in capacity, that are not eligible for other Market Sectors, fall under the Managed Growth sector.

- Unlike other Market Sectors, the Managed Growth sector is capped year over year. The 2014 capacity limit is 26 MW. The 2015 capacity limit is 80 MW.

- Facilities are eligible to apply for an Assurance of Qualification (i.e., a place in the SREC-II program assuming other future criteria are met) without first obtaining a Permission to Operate (PTO). This is most relevant for systems that fall under Managed Growth.

- Given the limited capacity of the Managed Growth sector, we recommend that impacted facilities apply for an Assurance of Qualification. It is expected that this capacity will be filled quickly.

Click here for a PDF of slides (complete with program definitions) and here for a link to a recording of our webinar covering the launch of SREC-II. Below is the summary of the various SREC-II Market Sectors:

How to Apply for an Assurance of Qualification with SRECTrade

You may apply for an Assurance of Qualification using SRECTrade’s online application starting Tuesday, May 6th. If you would like to submit the Assurance of Qualification documentation prior to May 6th, please contact us directly.

What’s Required to Submit an Assurance of Qualification?

Assurance of Qualification applications require the same information needed for a Statement of Qualification application. Additionally, the information detailed below is also required and must be uploaded to SRECTrade’s online application form.

- An executed Interconnection Service Agreement (ISA), as tendered by the distribution company;

- Adequate site control (a sufficient interest in real estate or other contractual right to construct the Unit at the location specified in the Interconnection Service Agreement); and

- All necessary governmental permits and approvals to construct the Unit with the exception of ministerial permits, such as a building permit, and notwithstanding any pending legal challenge(s) to one or more permits or approvals.

Please note, SREC-II Assurance of Qualifications will be filled based on date of application submission. The ISA date of execution will serve as a tie breaker for applications submitted on the same day, and if the ISA date is the same for multiple applicants, the DOER will utilize a lottery process to determine the queuing position of the Assurance of Qualification application. Additionally, the DOER has provided preliminary guidance that the first week of Assurance of Qualification submissions will be treated as if they were submitted on the same day. For example, date of submission from May 6th through May 13th, will not be used to determine receipt of Assurance of Qualification. Rather, the ISA will be the first determining factor.

Also, the DOER has been recommending that projects outside of the Managed Growth category do not need to submit an application for Assurance of Qualification. There will be plenty of room under the SREC-II cap and it is not necessary during the initial stage of the program. Lastly, smaller residential and commercial projects (i.e., 25 kW and less) will likely be provided room under a future provision as the program gets close to meeting its cap.

For applications related questions

Allyson Umberger

Director of Regulatory Affairs and General Counsel

allyson.umberger@srectrade.com

(415) 763-7790

For brokerage related questions

Alex Sheets

Director of Environmental Markets

alex.sheets@srectrade.com

(802) 989-2617

For installer related questions

Sam Rust

Director of Business Development

sam.rust@srectrade.com

(415) 729-3546

Other contacts

Steven Eisenberg

Chief Executive Officer

steven.eisenberg@srectrade.com

(415) 702-0863

Tom MacKenty

Associate, Environmental Markets

tom.mackenty@srectrade.com

(415) 409-8537