SRECTrade SREC Markets Report: March 2012

The following post outlines the megawatts of solar capacity certified and/or registered to create SRECs in the Solar REC markets SRECTrade currently serves.

A PDF copy of this table can be found here.

PJM Eligible Systems

As of this writing, there were 23,871 solar PV and 287 solar thermal systems registered and eligible to create SRECs in the PJM Generation Attribute Tracking System (GATS). Of these eligible systems, 139 (0.58%) have a nameplate capacity of 1 megawatt or greater, of which 14 systems are greater than 5 MW. The largest system, the PSE&G utility pole mount project located in New Jersey, is 25.1 MW, and the second largest, located in New Jersey is 12.5 MW. The third largest system, at 12 MW, is located in Ohio.

Delaware: The reporting year 2011-12 (6/1/11 – 5/31/12) requirement for DE equates to approximately 23,700 SRECs being retired. If all retired SRECs were of DE2011-12 vintage, approximately 19.8 MW would need to be operational all year long. As of April 4, 2012, 27.8 MW of solar capacity was registered and eligible to create DE SRECs in PJM GATS. 11.2 MW of the 27.8 MW currently eligible is from the Dover Sun Park project developed by LS Power. In the 2011-12 compliance year, Delmarva Power has contracted to purchase 9,846 SRECs from the project, of which 7,000 are being held by the Sustainable Energy Utility (SEU) until 2015-16*. Additionally, the DE SREC Pilot Program solicitation is under way, with a portion of the capacity tiers already closed. As of April 8, 2012, PJM GATS reported the issuance of approximately 19,600 DE2011-12 vintage SRECs. Additional SRECs from prior eligible periods may also impact the market should there be a demand for these older vintage SRECs.

Maryland: The end of February marked the first issuance period of MD2012 SRECs in PJM GATS. As of April 4, 2012, 44.0 MW of MD sited solar capacity was registered to create MD eligible SRECs. 2012 Solar RPS requirements are estimated at 56.1 MW or approximately 67,310 SRECs. Legislation is making its way through the MD legislature to pull forward the RPS requirements. As of April 8, 2012, PJM GATS reported the issuance of approximately 5,500 MD2012 SRECs. Additionally, all out of state MD systems are no longer eligible to produce MD certified SRECs and their MD certification numbers have been removed from their systems in PJM GATS. Lastly, there are MD sited SRECs available from prior eligible periods, which could be utilized for compliance needs in 2012.

New Jersey: The New Jersey 2012 reporting year requires 442,000 SRECs to be retired. This equates to approximately 368 MW of capacity being operational all year long, assuming all requirements were met with current vintage year SRECs. As of April 4, 2012, 670.9 MW of solar capacity was registered and eligible to create NJ SRECs in PJM GATS. While this figure represents all projects registered in GATS, there are recently installed projects awaiting issuance of a New Jersey state certification number. This delay results in a portion of installed projects not yet represented in the 670.9 MW figure. As of February 29, 2012 the NJ Office of Clean Energy (NJ OCE) reported that 689.1 MW of solar had been installed in NJ. As of April 8, 2012, PJM GATS reported the issuance of approximately 386,500 NJ2012 SRECs.

Ohio: Ohio’s 2012 RPS solar target requires approximately 95,300 SRECs to be retired by the end of the compliance period. At least 50% of the SREC requirement must come from systems sited in the state. As of April 4, 2012, 44.9 MW of in-state capacity and 84.0 MW of out-of-state capacity were eligible to generate OH SRECs. A large increase of in state capacity recently came from a 9.8 MW project sited at the Campbell Soup facility in Napoleon, OH. As of April 8, 2012, GATS issued approximately 5,200 in-state and 11,200 out-of-state OH2012 eligible SRECs. Additional SRECs from prior years are also eligible for the current compliance period, which may impact the current year’s requirements.

Pennsylvania: The reporting year 2012 requirement for PA equates to retiring approximately 49,450 eligible SRECs. If all compliance obligations were met using 2012 vintage SRECs, approximately 41.2 MW would need to be operational all year long. As of April 4, 2012, 187.9 MW of solar capacity was registered and eligible to create PA compliant SRECs. As of April 8, 2012, PJM GATS reported the issuance of approximately 124,500 PA2012 SRECs. Given the oversupply during previous reporting years, there are also SRECs from the 2010 and 2011 reporting years eligible for the PA2012 compliance period.

Washington, DC: DC’s 2012 RPS amended solar target requires approximately 61,180 SRECs to be retired by the end of the compliance period. The figures displayed above demonstrate the capacity of systems eligible to create DC SRECs moving forward. These SREC and capacity figures do not take into consideration the amount of electricity delivered into the district that may be exempt from complying with the Distributed Generation Amendment Act increases, considering some electricity contracts may have been signed prior to the amendment’s implementation. As of April 4, 2012, 23.1 MW of capacity was eligible to generate DC SRECs. Additionally, as of April 8, 2012, GATS reported the issuance of approximately 3,100 DC2012 eligible SRECs. SRECs from prior years are also eligible for the current compliance period, which may impact the current year’s requirements.

Massachusetts DOER Qualified Projects

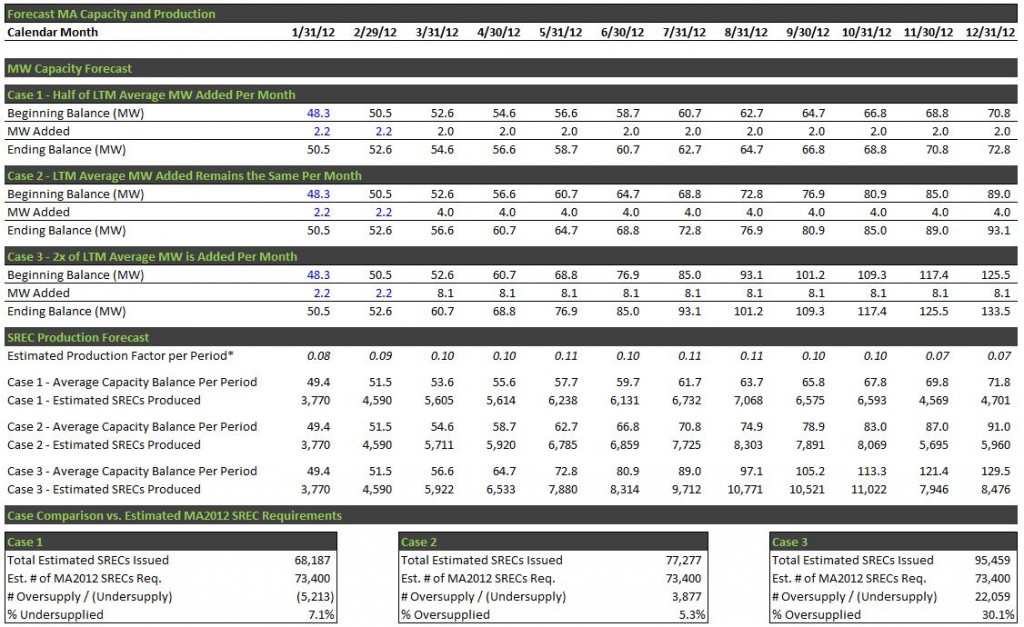

As of April 5, 2012, there were 1,728 MA DOER qualified solar projects; 1,698 operational and 30 not operational. Total qualified capacity is 64.1 MW, 53.7 of which is operational and 10.4 not operational. Electricity suppliers providing power to the state need to acquire approximately 62,900 and 73,400 SRECs in 2011 and 2012, respectively. Through the Q3 2011 issuance period (1/15/12), 19,257 SRECs have been minted. Additionally, more than 7,000 MWh have been reported to the PTS during Q4 2011. The Department of Energy Resources (DOER) projects approximately 29,000 SRECs to be generated in 2011, leaving the market short approximately 33,900 SRECs. The next issuance period for Q4 2011 SRECs will be on April 15, 2012.

For additional analysis on the current state of the MA SREC market and an outlook on 2012 see the following post published on March 16, 2012: Massachusetts SREC Market Update – March 2012

Capacity Summary By State

The tables above demonstrate the capacity breakout by state. Note, that for all PJM GATS registered projects, each state includes all projects certified to sell into that state. State RPS programs that allow for systems sited in other states to participate have been broken up by systems sited in-state and out-of-state. Additional detail has been provided to demonstrate the total capacity of systems only certified for one specific state market versus being certified for multiple state markets. For example, PA includes projects only certified to sell into the PA SREC market, broken out by in-state and out-of-state systems, as well as projects that are also certified to sell into PA and Other State markets broken out by in state and out of state systems (i.e. OH, DC, MD, DE, NJ). PA Out of State includes systems sited in states with their own state SREC market (i.e. DE) as well as systems sited in states that have no SREC market (i.e. VA). Also, it is important to note that the Current Capacity represents the total megawatts eligible to produce and sell SRECs as of the noted date, while the Estimated Required Capacity – Current and Next Reporting Year represents the estimated number of MW that need to be online on average throughout the reporting period to meet the RPS requirement within each state. For example, New Jersey needs approximately 368 MW online for the entire 2012 reporting year to meet the RPS requirement. Additionally, the data presented above does not include projects that are in the pipeline or currently going through the registration process in each state program. This data represents specifically the projects that have been approved for the corresponding state SREC markets as of the dates noted.

*Source: State of Delaware Pilot Program For the Procurement of Solar Renewable Energy Credits: Recommendations of the Renewable Energy Taskforce

Note: SREC requirements for markets without fixed SREC targets have been forecast based based on EIA Report updated 11/15/11 “By End-Use Sector, by State, by Provider”. Projected SRECs required utilizes the most recent EIA electricity data applying an average 1.5% growth rate per forecast year. The state’s RPS Solar requirement is then multiplied by forecast total electricity sales to arrive at projected SRECs required. Projected capacity required is based on a factor of 1,200 MWh in PJM states and 1,130 MWh in MA, generated per MW of installed capacity per year.

Tweet