Over the past few months, the market-based Solar Renewable Energy Certificate (SREC) incentive that led New Jersey to become the nation’s second largest solar market has quickly become volatile after an unprecedented influx of new solar installations. In the first 7 months of this year alone, supply in New Jersey has grown from 260 MW to 400 MW. Over 100 MW have come online in the past four months alone; an astonishing number considering that the state’s first 260 MW took 10 years to install! The increased solar capacity in New Jersey means that the supply of SRECs, which represent one megawatt hour of solar energy produced, will be greater than the required number (demand) set by the New Jersey Renewable Portfolio Standard (RPS) for the first time since the state transitioned to a market-driven incentive program. As a result, SREC values have dropped from $640 in June , a price that reflected an undersupply in prior years, to a low of $165 in September.

Significant oversupply troubles

A drop in price is expected in a market-based system when supply catches up to demand. Over the past three years, solar installations have benefited from relatively high SREC prices as the state industry struggled to keep up with the demand set forth by the RPS. Therefore, it should be no surprise that SREC values would drop now that supply has reached level of demand. However, the true problem facing New Jersey is not just that supply has caught up with demand, it is that supply has considerably overshot demand – and will likely continue to do so through the end of the 2011 calendar year until the Federal grant expires.

The “2012” Energy Year in New Jersey runs from June 1, 2011 to May 31, 2012. Based on the required number of SRECs required (442,000), the state needs approximately 370 MW of capacity running on average throughout the 2012 Energy Year to meet the SREC requirement. With 400 MW installed at the end of July (month 2 of 12), the state will easily meet it’s requirement this year. Based on the state’s projections, solar capacity could be at 500 MW halfway through the 2012 Energy Year – enough capacity to meet the 2013 Energy Year requirement of 596,000 SRECs!

There are a few reasons why supply has overshot demand in New Jersey. The rapid increase is driven by large projects in the state’s solar pipeline that have come online over the past few months. There are currently 465 MW of projects in New Jersey’s pipeline that have been approved, but aren’t yet installed. These projects take months – if not years – to put together as developers travel the arduous financing, sales, permitting and interconnection approval processes before beginning construction. As a result, a stream of projects initiated in 2009 or 2010 are coming online in a time when the SREC market looks dramatically different than when these projects were conceived. Many of these projects will be forced through to completion in order to take advantage of the Federal grant before it expires at the end of 2011, perhaps with the hope that the SREC market will eventually rebound after 2012. This is a dangerous assumption that would have significant consequences for the New Jersey SREC market.

Homeowners and small business owners are the most at risk

The portion of the solar industry that gets hit the hardest by SREC price decline are the homeowners and small business owners who invested in their own systems. These retail solar generators are at a severe disadvantage to solar farms built by large institutions. Viable long-term contracts are scarce in the market as a whole, but because energy companies will not enter into contracts with non-creditworthy generators selling in small volumes, such contracts are nearly non-existent in the retail sector.

While large institutions can lock in long-term SREC contracts, the retail sector has been required to place its faith in the integrity of the market. These retail solar owners were sold systems when SREC prices were above $600, most with the impression that the market would push those prices down gradually over time – perhaps to $400 in the mid-term, $200 in the long-run, and eventually to $50 or less. That “distant future” of sub-$200 SREC prices has become a reality today because of the state’s rapid growth of large commercial and institutional solar projects.

Stakeholders put forth solutions

The New Jersey Board of Public Utilities (BPU) will convene to address the status of the SREC markets with a number of stakeholders in a public hearing on Thursday, September 15, 2011 at 401 E State Street in Trenton, NJ from 1 to 5pm EST. This meeting is intended to review the program as a whole, but the major topic to be addressed is the current volatility in pricing. There have been several solutions put forth. Some are unlikely to be approved, while some others don’t really address the main issues. Here are the common themes put forth thus far:

Increase the Demand: The New Jersey legislature is considering a change to the solar RPS that would move all of the yearly requirements forward by one year starting in 2013. The additional demand is intended to reduce the downward pressure on pricing. Unfortunately, this is a short-term solution that only postpones the underlying problem. New Jersey is on pace to add 250 MW of solar in this calendar year. Over the next 5 energy years, the RPS can only accommodate an additional 120-160 MW of solar in any given year. Moving the requirements up one year means that 2013 can accommodate 250 MW of added solar, but 2014 would drop back down to growth of 150 MW. If the state were to increase demand in a meaningful way to support the solar industry, it would need to start with annual growth of 250 MW as a baseline and increase it each year from there. Given the current political and economic climate, this type of support from the state seems unlikely – though it should really be given some serious thought, particularly in light of the Solar Alliance’s response to Christie’s Energy Plan.

Increasing demand also does not address the real problem here, which is that the NJ solar industry is unable to pace its growth within the confines of the established incentive structure. How do you get an industry able and willing to grow at a rate of 250 MW a year, to slow down to 150 MW? This problem doesn’t go away if the demand is increased to 250 MW in 2013, but the industry continues to scale up to the point where it adds 400 MW that year. Some are advocating that the industry learn this lesson the hard way, and to let the SREC price collapse play out. That would indeed be tough medicine for the industry; but the impact of such a price collapse, as we pointed out earlier, extends beyond the “industry” to the 10,000 solar system owners – many of whom are small-scale system owners who stand to face significant financial losses.

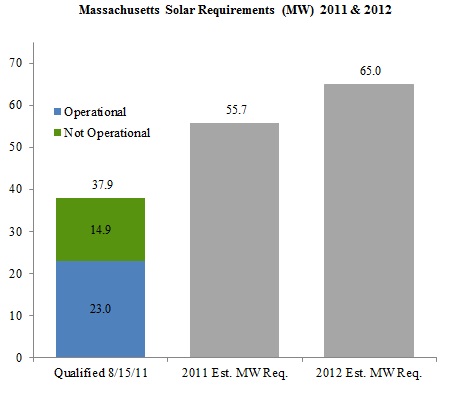

Establish a Floor Price: Massachusetts is currently the only SREC market with an established floor price, better described as a price support mechanism. It has been well-received particularly by the retail sector; however, the fact that the support mechanism has yet to be tested remains a key hurdle for many institutional players. Unfortunately, the differences in the way the New Jersey and Massachusetts markets are structured make it impossible for New Jersey to copy the Massachusetts model. Massachusetts designed it’s price floor by employing a creative set of rules that further incentivize energy companies to buy SRECs above the floor price, thus avoiding putting state resources at risk. Simply put, one mechanism the state can utilize is to increase the SREC requirement from one year to the next in order to assure that the market stays above the price floor. The RPS law in New Jersey, however, focuses on “predictability” – by design, the yearly SREC requirement through 2026 is predetermined and the BPU cannot alter those requirements. Since NJ does not have a maximum capacity target of systems eligible for the SREC program (like MA does), the cost to the state could skyrocket with the imposition of a long-term price floor. Establishing a floor price mechanism in New Jersey that doesn’t put the state’s resources at risk would probably require a difficult overhaul of the program.

Require Long-Term Contracts: The concept of long-term contracts has proven, time and time again, to be at odds with a competitive electricity industry in New Jersey. Any proposals to this effect have quickly been shot down by the state legislature due to fears of locking electricity suppliers into long-term rates. The RFP solicitations put out by the state’s four electric distribution companies (or EDCs), JCP&L, PSE&G, RECO and ACE, have been the primary source of long-term SREC financing in New Jersey. Combined, these programs were capped at 140 MW of solar installations. As of the end of 2010, only 60 MW of the 260 MW installed in New Jersey had been installed from these programs. The EDCs don’t actually need to buy SRECs – the requirement is imposed, rather, on the state’s load serving entities (i.e. the electricity suppliers) – therefore the SRECs purchased by the EDCs in these programs are actually just sold back into the market. The EDC programs had been promoted by the BPU over the past few years because the state was struggling to meet it’s solar goals. Because a condition of the EDC program was that the EDCs were able to pass any losses on to their ratepayers, the 10-15 year contracts attached to the program could end up hurting ratepayers. In 2010, 10-year contracts signed by the EDCs ranged from $426 to $465/SREC. Given current spot market SREC pricing, the EDCs stand to lose money on these contracts beginning in 2012. The RFP solicitations are set to expire in 2012 and it will be up to the BPU to determine if they should be extended. Given that they were initially established to support a market that was falling behind, it may be that the BPU decides the market can move forward without these programs. Nonetheless, if long-term contracts are made available to the entire market in a sustainable way, they would go a long way to address volatility concerns.

These solutions, however, can each be seen as trying to address the question: How do we avoid the forces which are inherent to a market? Price uncertainty and insufficient demand are normal forces in any competitive market. These proposed solutions, however, are shifting focus away from the true problems facing SREC markets and the main question that people should be asking, which is: How do we make this market work better so that we don’t run into these “emergency” situations? The concept of a market-based approach to incentives being successful relies on the assumption of efficient, rational markets. In SRECTrade’s experience, we see a lot of inefficiency and plenty of irrational behavior in the SREC market. In our opinion, the key focus needs to be placed on the answering the following two questions:

(1) Why does the supply-demand balance swing from one extreme to the other?

There is a significant time gap between the market signal (pricing) and the input (installing solar). Customers are sold systems based on today’s SREC price signal and then installed 3, 6, 9, 18 months from now; at which point the market could be fundamentally different. In an efficient market, the decision to buy something would result in an immediate action. With SRECs, the decision to buy does not yield an action for several months. This inefficiency manifested itself last year in New Jersey when the market was so attractive that everyone jumped signed up while the prices were high. As we fast forward to today, those projects are finally entering an already-flooded market, likely pushing through (despite a crashing SREC price) since they have already reached a “point-of-no-return” stage of the project. The BPU tries to address this by requiring projects to register during early stages, thereby creating a signal to the market that there is going to be incoming supply. The problem with this “pipeline”, however, is that there is no way of predicting if and when these registered projects will be built.

These issues are further exacerbated when you look at how incentives are aligned. Project developers make a living by selling and building solar systems. The last person who would want to admit to a prospective customer that the SREC market outlook is bleak is the sales person. Who can blame them? While there are companies that take a long-term approach to building a business, there are plenty of new entrants in the solar industry who need to find every possible angle to spin SRECs in a positive light because their business is dependent on getting this or the next deal done. It’s a real-life example of game theory – if everyone jumps in, everyone suffers; but, if you’re sitting on the sidelines while your competitor is overselling the benefits of SRECs, he or she is making money and you are losing business.

(2) Why are SREC prices so wildly volatile?

The other issue is a structural one that adversely affects price volatility in the market from one year to the next. Load-serving entities (LSEs), more commonly referred to as “electricity suppliers”, are the “natural” buyers of SRECs – meaning they are the entities that ultimately need them to satisfy the state’s requirements. They are required to report their SRECs to the BPU at the end of September each year, which in a June to May energy year like NJ means the compliance year’s SRECs are due 15 months after the trading period begins.

Natural buyers have no reason to be active in the market until the very end of the trading period. This has been historically evident in nearly all SREC markets, with the exception being New Jersey in energy years 2010 and 2011 when a severe under-supply meant that buyers needed to compete throughout the year. If you look at price trends in New Jersey in 2009, Massachusetts, Maryland and Ohio, SREC markets consistently see a spike in activity – and increase in pricing – at the end of the trading period (May – August in New Jersey, March – April in the other states whose compliance requirements follow a calendar year).

In an oversupplied market, natural buyers know that the SRECs they need will be available at the end of the year. They have little incentive to be active buyers in months 1-5 when they don’t truly need their SRECs until month 15. Meanwhile, sellers don’t have the luxury of waiting until month 15 for their cash flows. What follows is a staring contest (favoring buyers) as sellers get more and more desperate to sell their New Jersey SRECs, while traders benefit from the ensuing panic. Anyone that understands project finance in New Jersey knows that the economics don’t support SREC values at $165, but yet that’s where they are trading – not because that’s what the “market” is for SRECs, but because a few sellers have sold into what has become a trader’s market.

Third party traders do play a valuable role in the SREC market by providing liquidity throughout the year, but they also benefit from the volatility. With no urgency coming from the natural buyers, traders are meeting the needs of sellers chasing liquidity at any cost. This has driven SREC prices well below where anyone expected, and as long as the natural buyers can sit on the sidelines, the market will continue to cannibalize itself to the ultimate benefit of traders and LSEs. Addressing this structural issue would create more consistency in the market throughout the year. It doesn’t mean that New Jersey would go back to trading at $500+ (it won’t trade that high again) but prices would trend along a much smoother curve and settle at a value that is rational in the market. With more volume traded on a regular basis, the market would better reflects today’s solar economics.

The long-term solutions in New Jersey would first address the mechanisms driving supply into the market in a way that promotes rational behavior. Some suggestions have been to regulate the supply coming into the market. That may give the BPU too much influence over a “market”. Ultimately, the answer will have to balance the needs of a competitive market with the assurances that everyone is acting in the best interests of the long-term viability of the market.

The BPU should also look at solutions that mobilize natural buyers earlier to create more consistent demand throughout the year. For a variety of reasons, it probably would not be feasible to break the reporting year into monthly or quarterly periods, though that could be one proposed solution. A modified solution would be to include the transaction date in the end-of-year report, with a requirement that the LSEs are held to some form of standard with respect to equal participation throughout the year. Either way, the inconsistency between the seller’s need for liquidity throughout the year and the buyer’s lack of urgency should be a key focal point for stakeholders looking at ways to address the volatility in the New Jersey market.