SREC market structure is primarily determined by two major policy levers: Renewable Portfolio Standards (RPS) and the Alternative Compliance Payment (ACP). RPS schedules determine the amount of energy coming from various renewable generation sources, solar included. ACP schedules set the maximum possible price that credits such as SRECs can reach in the market. When a state adjusts the RPS or ACP, market participants on both the demand and supply sides of the SREC market need to adapt to the new environment defined by these two factors. This transition often takes time to complete and can create market instability and uncertainty in the interim.

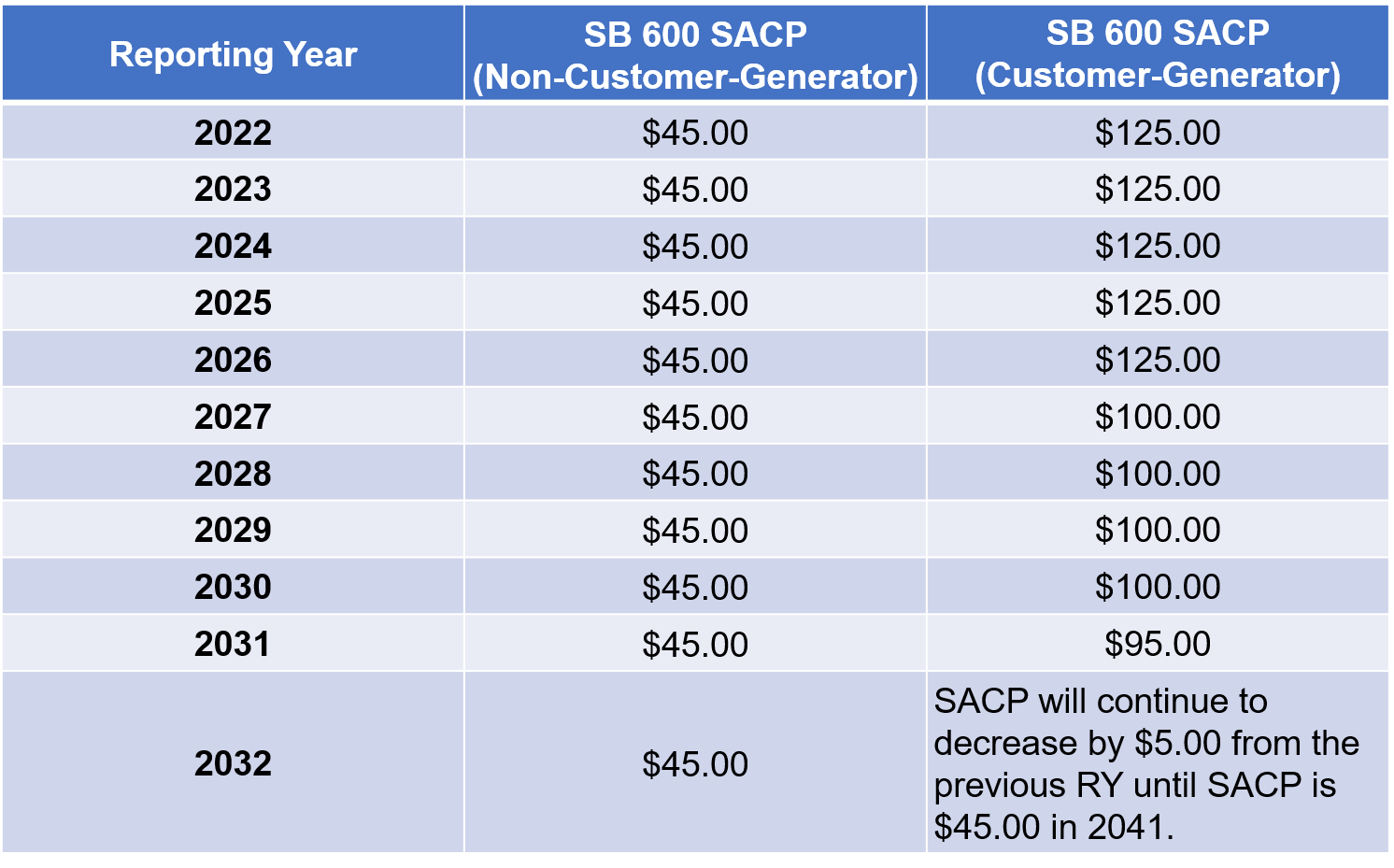

The Washington, DC market is currently in the midst of such a transition. The Renewable Portfolio Standard Expansion Act of 2016 (B21-0650), signed last July and put into effect on Oct 8th, 2016, has already made waves in the Washington D.C. SREC market. As stipulated in the legislation, state renewable generation and solar carve-out targets have increased to 50% and 5% respectively by 2032. The bill complements this RPS expansion with an increase in the ACP or the financial penalty for non-compliance by electricity suppliers. The side-by-side comparison of the ACP schedule before and after the recent policy shift is as follows:

While in theory this ACP increase bodes well for owners of photovoltaic systems selling SRECs into the market, we have seen a slower demand adjustment from the utilities and power providers, the DC market’s natural compliance buyers. As a result, sellers have experienced a lack of liquidity for their SRECs during a time of seemingly favorable market conditions. The lack of demand for SRECs at the current spot market price can be partially attributed to a clause in B21-0650 which states that the new ACP schedule does not apply to any utility load contract entered into before October 8th, 2016. This grandfathering of competitive electricity supply contracts means utilities and load serving entities (LSEs) have two different RPS programs they are simultaneously subject to, as some of their contracts are subject to the old $350 ACP and some subject to the new $500 ACP. In effect, SREC demand is split between the old and new program.

Reflective of the $150 difference between the previous program’s and current program’s ACP for calendar year 2017, the price of DC17 SRECs increased from $320 to $480 from October 2016 to February of 2017. However, due to compliance buyers balancing their purchases between the $350 and $500 obligation levels, the market has settled to levels that reflect a balance between the two separate ACP levels for calendar year 2017.

While prices may continue to decrease slightly as compliance buyers better understand their future SREC needs, we expect that over the coming months the market will begin to stabilize and recover. Buyers will inevitably adapt to the policy changes and assess their positions with regards to the two RPS obligations. The brokerage desk at SRECTrade has been working closely with buyers to better understand their obligations and ensure that the market remains liquid and accessible to all sellers.

As always, please feel free to reach out to the SRECTrade client services team, or your brokerage desk contact, to further discuss the current status of the market and our outlook on SREC pricing.

Disclaimer. This document, data, and/or any of its components (collectively, the “Materials”) are for informational purposes only. The Materials are not intended as investment, tax, legal, or financial advice, or as an offer or solicitation for the purpose or sale of any financial instrument. SRECTrade, Inc. does not warranty or guarantee the market data or other information included herein, as to its completeness, accuracy, or fitness for a particular purpose, express or implied, and such market data and information are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Any comments or statements made herein do not necessarily reflect those of SRECTrade, Inc. SRECTrade, Inc. may have issued, and may in the future issue, other communications, data, or reports that are inconsistent with, and reach different conclusions from, the information presented herein.

Copyright. This document is protected by copyright laws and contains material proprietary to SRECTrade, Inc. This document, data, and/or any of its components (collectively, the “Materials”) may not be reproduced, republished, distributed, transmitted, displayed, broadcasted or otherwise disseminated or exploited in any manner without the express prior written permission of SRECTrade, Inc. The receipt or possession of the Materials does not convey any rights to reproduce, disclose, or distribute its contents, or to manufacture, use, or sell anything that it may describe, in whole or in part. If consent to use the Materials is granted, reference and sourcing must be attributed to the Materials and to SRECTrade, Inc. If you have questions about the use or reproduction of the Materials, please contact SRECTrade, Inc.