On June 1, 2021, Maryland Governor Larry Hogan allowed Senate Bill 65 (SB 65) to pass into law without his signature. SB 65 revises Maryland’s Renewable Portfolio Standard (RPS), decreasing the solar carve-out from 2022-2029 while increasing its solar alternative compliance payment (SACP) from 2023-2029. The new law still requires 50% of MD electricity sales from Tier I renewable energy resources with a 14.5% solar carve-out by 2030.

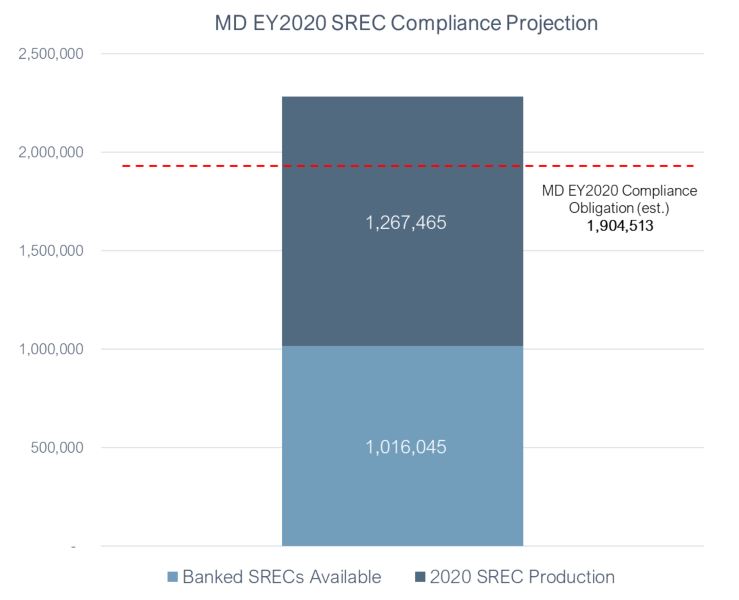

This adjustment to Maryland’s RPS should bring a more gradual increase to the solar carve-out requirement. Our enclosed analysis projects the 2021 market and forward years to be undersupplied – we expect the degree of undersupply to increase in years 2022 and 2023 and show a moderate decrease in year 2024. The forecasted degree of undersupply seen in years 2022-2024 has seen a substantial decrease from our previous analysis due to the recent reductions in RPS. While we project that the new changes to Maryland’s RPS will decrease the degree of undersupply seen in forward years, build rates still must show a substantial increase in order to keep up with the new RPS schedule.

Current MD SREC pricing has been consistent over the last few months with 2021 SRECs pricing around $77.50, 97% of the ACP and 2022 SRECs pricing around $57.00, 95% of the ACP.

Final 2021 MD SREC production, final 2021 MD load figures, and actual grandfathered load could impact the degree of undersupply seen in 2021 and forward years.